This post first appeared on Risk Management Magazine. Read the original article.

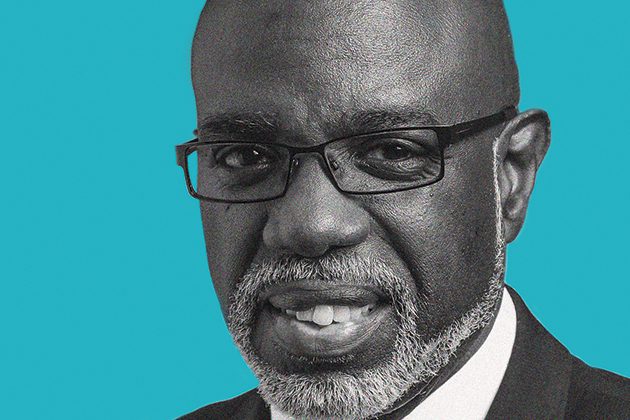

Robert Cartwright, Jr., RIMS president for 2018, is a firm believer in networking, communicating and connecting with local communities and RIMS chapters. A RIMS member for more than 25 years, he has served on its board of directors for a decade, and remains active with the RIMS Delaware Valley Chapter where he has held every board position, including president. As a division manager of environmental, health, safety and sustainability for Bridgestone retail operations, Cartwright oversees more than 400 locations in 14 states. He spoke to Risk Management about getting into risk management, the evolution of the profession, making risk relevant to the entire organization, and what he wants to focus on during his presidency.

Risk Management: How did you get into risk management?

Cartwright: I would say that, like other veteran risk managers out there, you don’t get into risk management, risk management chooses you. Today, new risk managers go to college and get degrees in risk management, but my background was human resources. When I went into HR in the 1990s, I managed one plant. They also gave me operations, and the first thing we had to handle was a six-figure OSHA fine. I reported it to the company and they said, ‘And you’re going to fix this, right?’ So that was my baptism by fire. I had to learn what to do because that wasn’t my background. Years later, when I moved to Bridgestone, I took over their workers comp program. I wanted to learn more about risk management so I reached out to a local RIMS chapter. Then I got my CRM designation and I learned that there was a component outside of insurance that looks at how to analyze what risk is. So by trying to resolve a problem in my company, I discovered there were a lot of resources out there. Tapping into them is how I got into risk management.

RM: How has risk management itself evolved during your career?

Cartwright: What I’ve seen in my own company is the ability for me as a risk manager to introduce concepts and ideas about risk into the organization, but you have to weave that into the language your company is speaking. In a lot of organizations, risk is not viewed as a profit generator, but as a cost. But when you start talking about generating profit from a risk management position, you’ve got everybody’s attention, because you’re changing the thought processes and introducing new terminology—and that’s how they see the benefits of a risk manager. So now what happens is that you’re included in the operational conversation. Now you know you’ve arrived as a risk manager in your organization.

You have to look at risk from an operational perspective because risk management is part of operations, whether you’re looking at a policy that will protect from certain exposures or putting certain practices into place, it’s all operational. There is a certain core connection. When you talk about the board and C-suite of a company, everyone is really in the same boat because of the mission, goals and metrics of the organization and everyone contributes towards that. If we have a 1970s mindset that we silo each person into what they do, everyone becomes isolated and they forget they are all supposed to be working towards the goals of the company. When we are uniting everybody, we all look and say, “there is an element of risk,” and “here is the risk tolerance of our organization,” and “here are the exposures,” so how do each of us help mitigate them?

Risk management used to be isolated to the insurance field. Now we are talking about people who are outside of insurance. We’re talking about IT, HR and health care. Technology is changing the role of the risk manager as well. Insurance has become just one way to mitigate these risks.

RM: As RIMS president, what will you be focusing on this year?

Cartwright: My theme is “legacy” and by that I mean using successes of the past to generate future success. The foundation has been laid for us—we have worked through a lot of innovations that should help us build a stronger and better future. We have the next generation of risk managers coming in and veteran risk managers are willing to pass on their knowledge to them, so that they can build on it and take the profession forward. If there is no forward thinking there is no sustainability, and if we don’t look ahead, we will not be viable as an organization.

I’m challenging other risk managers to examine what they’re doing and what their mark will be on their communities and their businesses. There is a very strong passion for RIMS and people like to volunteer for things they are passionate about. Mentoring is a very good thing, for example, and it helped me. Diversity and inclusion are also important for a lot of organizations and RIMS is looking at that—I have asked the board to put together a diversity and inclusion task force to address those issues. We’re a big organization—we are the risk management society—so we need to think about where we are going. What we’re doing here with our local chapters and our membership worldwide, that is who we are as an organization. We have almost 10,000 members globally, and we are all in this together. Let’s communicate, articulate and share best practices. Let’s get on the same page and move this organization forward.

RM: What is your advice for how risk professionals can advance their careers?

Cartwright: My advice is to get connected. Get connected within your local communities and your chapters. For those who are chapter leaders, get connected with your board liaisons. Communication is always the biggest problem and sometimes we move toward things that we think we know based on assumption, and that creates error and lost time. Part of my platform is that I want to have a better understanding of the issues you are facing. So let’s talk. Let’s find out what we need to do going forward to make this organization better and stronger and create our own legacy so we can stay relevant and vibrant in the 21st century.