This post first appeared on IBM Business of Government. Read the original article.

Responding to the challenges caused by the pandemic has been a top priority for governments around the world.

Listen to our interview with David A. Lebryk.

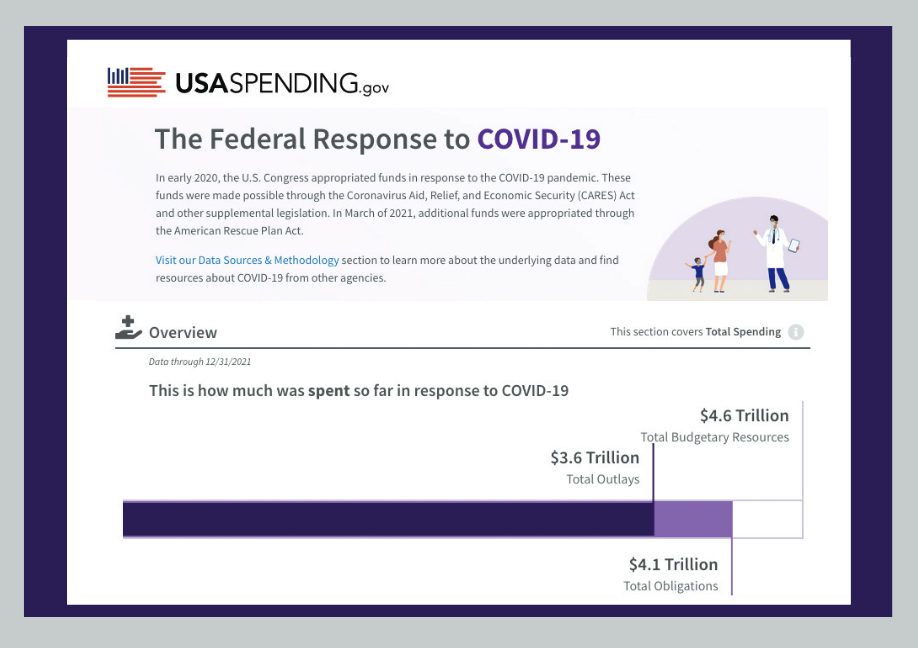

The U.S. enacted several legislative packages over the past two years that total more than $4.5 trillion in new budgetary resources across the federal government. When you compare the pandemic response to the American Recovery and Reinvestment Act of 2009, which was about $800 billion, the scope of the challenge to implement these new resources becomes clear.

The federal financial management community was not directly on the frontlines of the pandemic response but did work effectively to ensure that federal resources were deployed quickly and responsibly during this crisis. The foundation of accounting standards, internal controls, and reporting, set over the past 30 years, enabled the rapid response from the financial management community across government.

Over the past few years, the Bureau of the Fiscal Service at the U.S. Department of the Treasury has made progress toward becoming a more agile organization; during the pandemic it became necessary to speed up those practices. We’ve learned to move quickly, rely on technology, remove silos and take more responsible risks. Recently, the National Academy of Public Administration (NAPA) established an Agile Government Center to share best practices for providing public goods and services that fully meet customer needs and to build public trust. The center identified agile principles that can be helpful to government leaders. Building on those NAPA principles and our experiences during the pandemic, here are a few lessons we’ve learned.

- Focus on the customer. During the pandemic, our customers were businesses and taxpayers facing unprecedented economic disruption or hardship. We learned to keep customers at the center of our work. It’s crucial to talk to your customers and not make assumptions based on your perspective inside government.

- Make innovation routine. We innovated out of necessity during the pandemic, rethinking long-standing business processes, and we encouraged innovation and new ways of meeting challenges and customer needs.

- Break down silos. Large organizations develop silos over time that impede innovation and rapid response. We learned that tapping talent and resources from across the organization, forming small cross-cutting teams, and empowering staff to solve problems is essential.

- Be responsive. Our staff was ready to respond quickly and was fully committed to success. In any emergency, response time is vital. To mobilize resources as quickly as possible, existing government processes and systems should be flexible and allow for rapid updates to existing policies, standards or guidance.

- Collect and use data. Good data matters. Setting a foundation to collect data from across the enterprise allows for expedited reporting to inform leaders, make data-driven decisions, and provide transparency to the public.

- Take responsible risk. By nature, government bureaucracies are risk averse. A crisis forces leaders to take risks they might not otherwise pursue. Agile processes allow for responsible risks, such as development of minimally viable products and policies that can be tested and continuously improved over time.

- Invest in people. Our people made the difference. Investments in a workforce that is knowledgeable, flexible, customer-focused, and dedicated to the mission pay off in the long run. Most importantly, develop a learning culture within your organization that promotes curiosity, the development of new skills, and problem solving.

Applying these principles was a key factor in our ability to issue three rounds of economic impact payments in record time and make continuous improvements throughout each round of payments. For the first round of payments in 2020, we issued the first 81 million payments within 15 days of the President’s signature, and we made a total of approximately 159 million payments within eight weeks of the first payment. In contrast, the last time similar payments were made, in 2011, the first payment went out 11 weeks after the legislation was signed, and it took three months to issue a total of 116 million payments.

A dramatic increase in the use of electronic payments and the implementation of a debit card program within six weeks of the first payment issuance helped in first and subsequent rounds of economic impact payments. In the second round in January 2020, we issued 113 million payments within three days of the President’s signature and more than 145 million payments within four weeks.

By the third round in 2021, we were able to convert many check payments to direct deposit using existing payment data, which further accelerated payment delivery for many and increased the electronic payment rate in the third round to 82% — up from 74% in the first round. We estimate this innovation saved more than $30 million in check production costs during economic impact payments and child tax credit payments; at the same time, we significantly improved the taxpayer experience. In short, applying the above principles worked to great effect both for the government and the customer.

As we reflect on the lessons of the past two years, technological advancements were essential to delivering government services during the pandemic, particularly as they relate to remote work. The seamless transition to telework for many federal employees would not have been possible 30 years ago, and it will continue to influence the future of work.

Let’s hope the pandemic will be behind us soon. However, it is important to use what we’ve learned over the last two years to further improve public service and strengthen trust in government. These lessons, rooted in agile principles, will strengthen the government’s ability to be responsive, embrace change, and deliver to the needs of the public.

**This article was first published by the Journal of Government Financial Management