This post first appeared on IBM Business of Government. Read the original article.

A recent roundtable discussed the potential for artificial intelligence to improve service and operations for the IRS, and for tax agencies more broadly.

Artificial Intelligence (AI) has surged across government. National and international legislation has been proposed, and U.S. Federal agencies are now implementing requirements set forth in the new Executive Order on AI. Such policy and progress affect government work across civilian and defense sectors – including work done by tax agencies with the public and business communities.

Driven by common access to AI and the potential benefits of Generative AI, the U.S. Internal Revenue Service (IRS) and tax agencies around the world are now focusing on how the technology could improve tax administration while minimizing some of the risks. To better understand opportunities and considerations, the IBM Center for The Business of Government, in collaboration with American University Kogod Tax Policy Center (KTPC), recently hosted a global discussion on AI and the Modern Tax Agency. The findings from this session will be the subject of a forthcoming report from the IBM Center and KTPC. Below we share some initial highlights of the discussion.

The roundtable included leaders from the IRS and tax agencies from various nations, as well as experts in AI, in taxation from the public, private sectors, and the research community. Kicked off by Danny Werfel, IRS Commissioner, the roundtable discussion focused on three key topics:

- How can AI and related technologies better enable taxpayers, including small businesses, to navigate tax filings and address emerging areas of concern (e.g., cryptocurrency, energy tax credits, COVID relief)?

- Where is AI today in terms of streamlining operations, and what is its potential to improve tax administration?

- What are key considerations for governance and developing transparent and ethical AI?

AI Today

AI combines computer science and robust datasets to enable problem-solving. AI uses computers and algorithms to mimic human intelligence to understand, reason, and learn. To date, AI has been able to analyze content (documents, images, sound, movies, events, etc.) to make predictions and prescribe actions.

Artificial intelligence has gone through many cycles of hype. However, the release of generative AI capabilities, like OpenAI’s ChatGPT, marked a turning point. Generative AI adds a new level of capability – Gen AI programs can generate new content and better understand existing content. These models can learn and represent grammar, software code, images, and many other data types. The Organization for Economic Cooperation and Development (OECD) published a 2023 study on AI which noted that 65% of tax administrations around the world already use AI, 40% of countries use virtual assistants, and more than half of all global tax agencies are using AI for risk assessment.

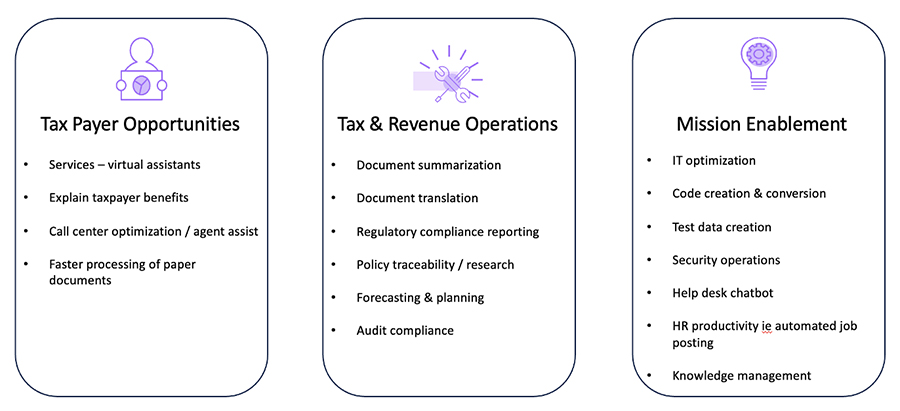

The graphic below captures examples of key applications of generative AI to taxpayer services and operations.

Taxpayer Assistance

As noted in the roundtable, agencies want to help taxpayers pay the correct amount of tax and claim the credits and benefits to which they are entitled. Governments want to enable taxpayers to file accurate returns the first time. This will reduce the burden on taxpayers and on tax agencies, while improving service. One agency has begun to test Generative AI to better understand and support individual taxpayers. This will better personalize service – a goal across tax agencies.

As noted by the OECD, most tax agencies have begun to use chatbots. Spain uses virtual assistants to answer questions about tax law changes affecting both corporations and individuals. After a 2018 change to the Value Added Tax process, a virtual assistant handled thousands of questions. It reduced e-mail traffic between corporations and the tax agency by about 80%. By comparison, the US IRS has several chatbots on its site, and Singapore has used them for nearly 10 years.

As AI tools increasingly facilitate answers to routine taxpayer queries, human agents can focus on more complex and strategic tasks. For taxpayers, this 24/7 service availability enhances the overall experience. Roundtable participants agreed that better service improves taxpayer satisfaction and encourages voluntary compliance.

Mission Operations and Enablement

A key area of interest involves using AI to streamline internal, repetitive, manual processes and improve administration. Participants discussed using AI internally to help employees find information on how to execute processes and procedures, and to summarize complex cases. AI can also be used to digitalize and streamline workflow associated with paper returns and correspondence.

Traditional tax auditing methods are often resource-intensive and time-consuming. With the help of advanced data processing capacity enabled by AI, tax agencies can conduct more efficient and targeted audits. Advanced algorithms can analyze vast datasets to detect anomalies, patterns of non-compliance, and potential tax fraud. This enables tax agencies to allocate their auditing resources more effectively and focus on cases with the highest likelihood of irregularities. Several participating countries use AI to identify tax evasion patterns, predict potential non-compliance, or to allocate auditing resources effectively.

Emerging generative AI applications can also enhance many internal, “back-office” operations. These opportunities range from policy and legislative impact analysis to drafting position descriptions for hiring. Increasingly, generative AI models will assist in extracting and documenting business processes. These can be building blocks of new code for modernizing legacy applications.

Governance and Ethical AI

Throughout the roundtable, the importance of governance, transparency, and ethical AI underpinned the discussion. These questions have international relevance. Large and complex tax agencies implement hundreds of applications. Chatbots and related apps are emerging across the app portfolio. An emerging challenge involves how to manage information to provide consistent answers across technology implementations.

Generative AI is new and increasingly powerful. Absent effective governance, even well-intended leaders could deploy this innovation in ways that generate poor results or undesired behavior. To capture AI’s benefits, government and industry can collaborate on ways to create trust in the technology and its uses. Governments should design and adopt clear policies that associate risk to AI uses.

The roundtable reflected on how government strategies can address multiple areas including:

- Bias & Discrimination

- Privacy & Confidentiality

- Transparency & Accountability

- Fair Use

- Erosion of Trust – Hallucinations

- Environmental Impact – Model Size & Resources

Next Steps

The IBM Center and KTPC are preparing a follow-up report on specific issues and ideas raised during the roundtable on AI in tax administration. Drawing on ideas and experiences from around the world, the report will focus on key considerations for the future and implications to IRS and other countries.

Header Image by rawpixel.com on Freepik